Thailand VAT Refund Guide : Tourist Tax Refund at iStudio by UFicon

What is VAT Refund?

VAT Refund (Value Added Tax Refund) is a special privilege for foreign tourists visiting Thailand who can claim a refund of the 7% VAT on goods purchased from participating stores in the “VAT Refund for Tourists” program.

This program is organized by the Revenue Department, Ministry of Finance, to promote shopping in Thailand and create incentives for tourists to purchase quality products from Thailand.

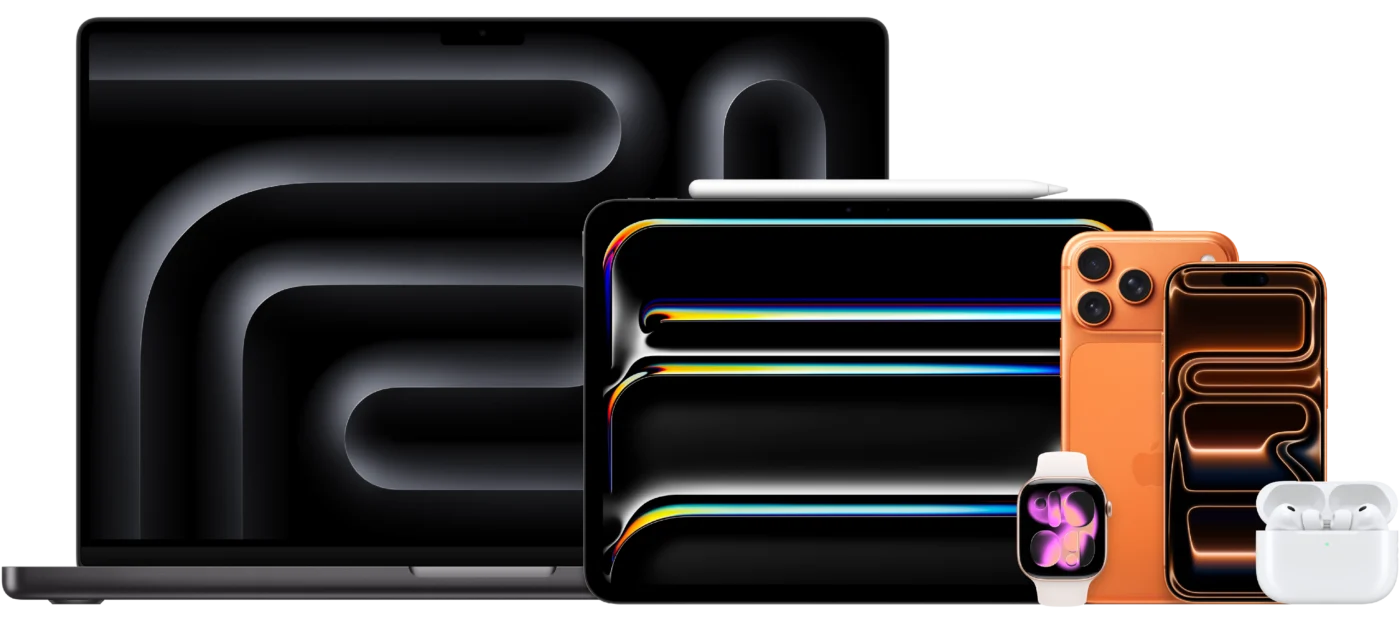

Shop Authentic Apple Products with VAT Refund Benefits

Tourists can purchase Apple products from all iStudio by UFicon branches and receive VAT refund benefits according to the Revenue Department’s conditions for a valuable, convenient, and confident shopping experience with authentic Apple products.

VAT refund at iStudio by UFicon helps you save on purchasing Apple products cost-effectively.

iStudio by UFicon – Authorized Apple Reseller

Shop quality Apple products with VAT refund benefits for foreign tourists.หรับนักท่องเที่ยวต่างชาติ

How to Receive VAT Refund for Tourists Benefits

Inform staff before payment so they can issue the P.P.10 or e-P.P.10 form on the purchase date only (very important), along with the original tax invoice for claiming refunds at the airport before leaving the country.

VAT Refund Conditions for Foreign Tourists

1) Eligibility Conditions

- Must be a foreign tourist (Non-Thai Resident)

- Stay in Thailand not exceeding 180 days per tax year

- Depart from Thailand via international airport only

2) Purchase Conditions

- Minimum purchase of 2,000 baht per tax invoice

- Total accumulated purchases (multiple days/invoices) of at least 5,000 baht per person

according to Revenue Department criteria - Request P.P.10 or e-P.P.10 form from staff “on purchase date only”

- Keep all complete tax invoices

3) Departure Conditions

- Must take goods out of the country within 60 days

- Show goods and documents for stamp at Customs Inspection before check-in

- After passing immigration, submit documents at the airport’s VAT Refund Counter

How to Request VAT Refund at iStudio by UFicon

- Select the Apple products you want

- Inform staff “I want to request VAT Refund”

- Show passport

- Staff will issue P.P.10 / e-P.P.10 form

- Receive tax invoice + form and keep for airport submission

Steps to Submit VAT Refund at Airport

- Before check-in:

- Go to Customs Inspection

- Show purchased Apple products and P.P.10 form

- After passing immigration:

- Go to VAT Refund Counter

- Choose refund method: cash / credit card transfer / bank account transfer

Product Categories Eligible for VAT Refund

Tourists can use VAT refund benefits for Apple products sold by all iStudio by UFicon branches, including:

- iPhone

- iPad

- Mac and MacBook

- Apple Watch

- AirPods

- Other accessories

Important Requirements for VAT Refund: Goods must be taken out of the country within 60 days from purchase date and must be unused in Thailand.

VAT Refund Rate Table Thailand (for Tourists)

Rates may change per Revenue Department criteria.

VAT Refund Calculation Examples for Tourists

Case 1: Purchase iPhone 17 at 29,990 baht

→ Refund = 1,500 baht

Case 2: Purchase iPhone 17 (29,990) + AirPods 4 (4,990)

→ Refund = 2,050 baht

iStudio by UFicon Branches Participating in VAT Refund for Tourists Program:

- iStudio @ Fashion Island View map >

- iStudio @ The Mall Lifestore Ngamwongwan View map >

- iStudio @ Terminal 21 Asok View map >

- iStudio @ The Promenade View map >

- iStudio @ Terminal 21 Korat View map >

- iStudio @ Robinson Lifestore Trang View map >

- iStudio @ Central Krabi View map >

View all participating branches > *iStudio by UFicon branches only

Shop authentic Apple products with VAT Refund benefits for foreign tourists at all participating iStudio by UFicon branches. Choose from iPhone, iPad, Mac, Apple Watch, and Accessories with confidence from an official Apple authorized reseller.

Q&A คำถามที่พบบ่อย

แหล่งอ้างอิง

ข้อมูลอ้างอิงจากกรมสรรพากร — รายละเอียดโครงการ VAT Refund for Tourists คลิก>